We all know how important it is to be open with those close to us when we’re going through difficult times with our mental health – and the same is true when we’re experiencing financial pressures.

Here, our partners at PayPlan – one of the UK’s largest free debt advice providers – have shared why it’s so important to talk about money, particularly at this time of year, in their latest blog:

This month, PayPlan celebrated Talk Money Week, a campaign supported across the industry to raise awareness and encourage everyone to be more open about money with friends and family – and help people get advice from experts if needed.

With the cost of living, inflation and rising interest rates all adding to everyday financial pressures, there has never been a more appropriate time to consider opening up about your finances.

Data from Money and Pensions Service’s’ Talk Money Week in 2021 revealed one in three (36%) say their financial situation makes them feel worried, while nearly one in two adults in the UK (45%) don’t feel confident managing their money day-to-day.

Why should we talk about money?

Research by Money and Pensions Service shows that people who talk about money:

- make better and less risky financial decisions

- have stronger personal relationships

- help their children form good lifetime money habits

- feel less stressed or anxious and more in control.

Building money conversations into our everyday lives also helps us build financial confidence and resilience to face whatever the future throws at us. You can hear what some of our partners had to say over on our website.

And with the festive season quickly approaching, you may feel additional financial pressures, so it’s important to speak to those around you to outline a plan and manage your budget so you don’t overspend.

Data from YouGov detailed that the average person expects to spend £1,108 during the festive period. This represents a rise of over £200 versus the average spend in 2020 (£883). Women say they will have a slightly higher average spend (£1,138) compared to men (£1,079).

The above figures include all six factors of spending during Christmas, which range from presents and gifts, hotel stays, food and drink, travel, social events and personal spending/new clothes.

The biggest cost here is presents and gifts which cost £388 on average last year, down from £408 in 2020.

How can I keep my Christmas shopping down this year?

It’s important to not fall for ‘Christmas deals’ and instead calculate what works for you. You could also explore cashback, loyalty card points, and trading in your used items to fund new presents. It’s worth noting that cashback and loyalty points will also help you in the long-term too and give you that extra boost towards next year’s shopping.

From handmade gifts to gifting your time with your closest loved ones, you shouldn’t feel pressured to spend outside of your comfort zone or make impulse buys. With many people cutting back on socialising because of the cost-of-living crisis, the festive period offers a great chance for families and friends to get together to enjoy each other’s company. The gift of time – whether it be enjoying scenic walks together, playing a board game or having a catch up over a cup of tea – spending time with your closest loved ones doesn’t cost a penny and can improve your mental wellbeing over what can sometimes be a lonely period for some.

Methods such as Secret Santa or agreeing on a budget cap within a group of friends/family is one way to cut costs – and shows you have thought about your gift. You could even try making your own gifts and getting your children involved in the process as a way of keeping the costs down.

This also goes for baking and cooking over the festive period, and with ready-made mince pies flying from the supermarket shelves, you could have-a-go yourself for less. Not only this, but it’s a way of spending more time with the ones you love most.

Starting your Christmas shopping early is also one way of reducing your expenses as you have more time to find the right price to fit your budget, should you choose to buy a gift for everybody in your family. But it’s important to make sure you shop around – even searching the web cuts down potential costs of driving, parking and impulse buys when visiting a physical store. It’s much easier to choose from a wider selection online and you also save on delivery when giving yourself time too, with Amazon and other websites offering free delivery when you opt for a long delivery time.

A recent shopping trend named ‘12 Days of Christmas’ asks shoppers to consider what they’re buying and if it holds any value or use after the Christmas period. This could be one way to ensure you’re thinking about what you’re spending your money on. Ask yourself the following questions:

- What money do you have available for Christmas (this is excluding all bills and priority payments)?

- What do you need to spend money on over the festive period?

- What do you want to spend your money on over the festive period?

If you’re worried about debts, it can be difficult to know where to turn, but it’s important to know you’re not alone.

At PayPlan, we’re specialists in finding solutions for people with multiple debts, and over the past 30 years, we’ve helped over one million people take control of their finances. Get in touch by calling 0800 072 1206 or visiting www.payplan.com/the-fire-fighters-charity.

We have a range of resources available to you to support you this winter. Find out more here:

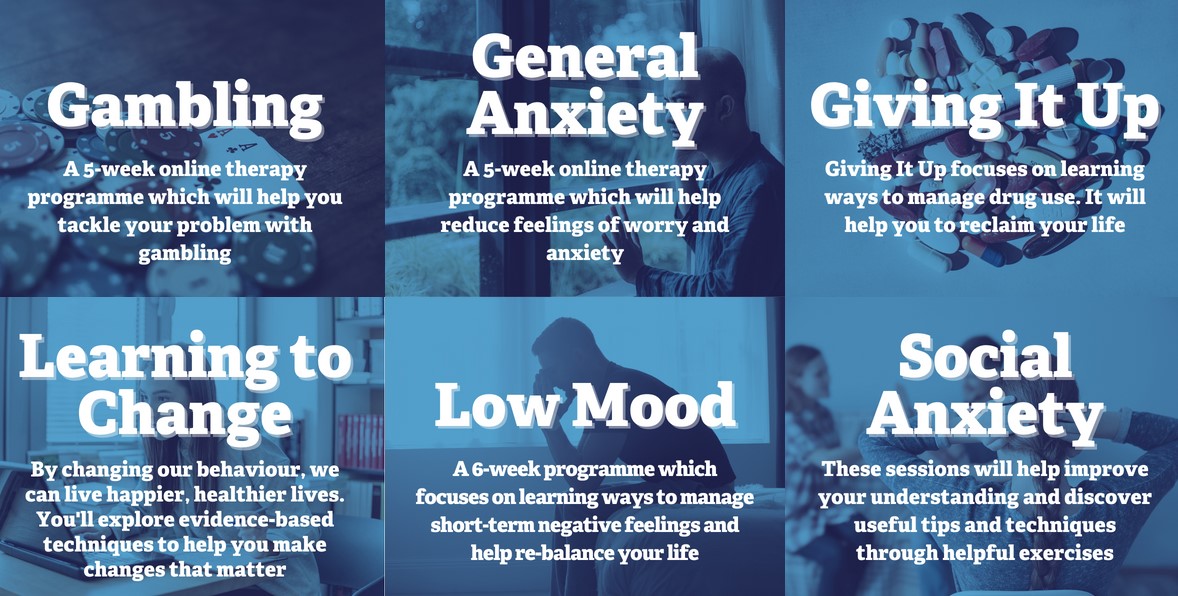

Try our full online courses on MyFFC

We have a great range of six-week online courses available through MyFFC, just log in and register for whichever course interests you. Available courses include: Learning to change; Low mood; General anxiety and Gambling.